The State of Hotel Advertising: The Rise of Display in the World of Meta

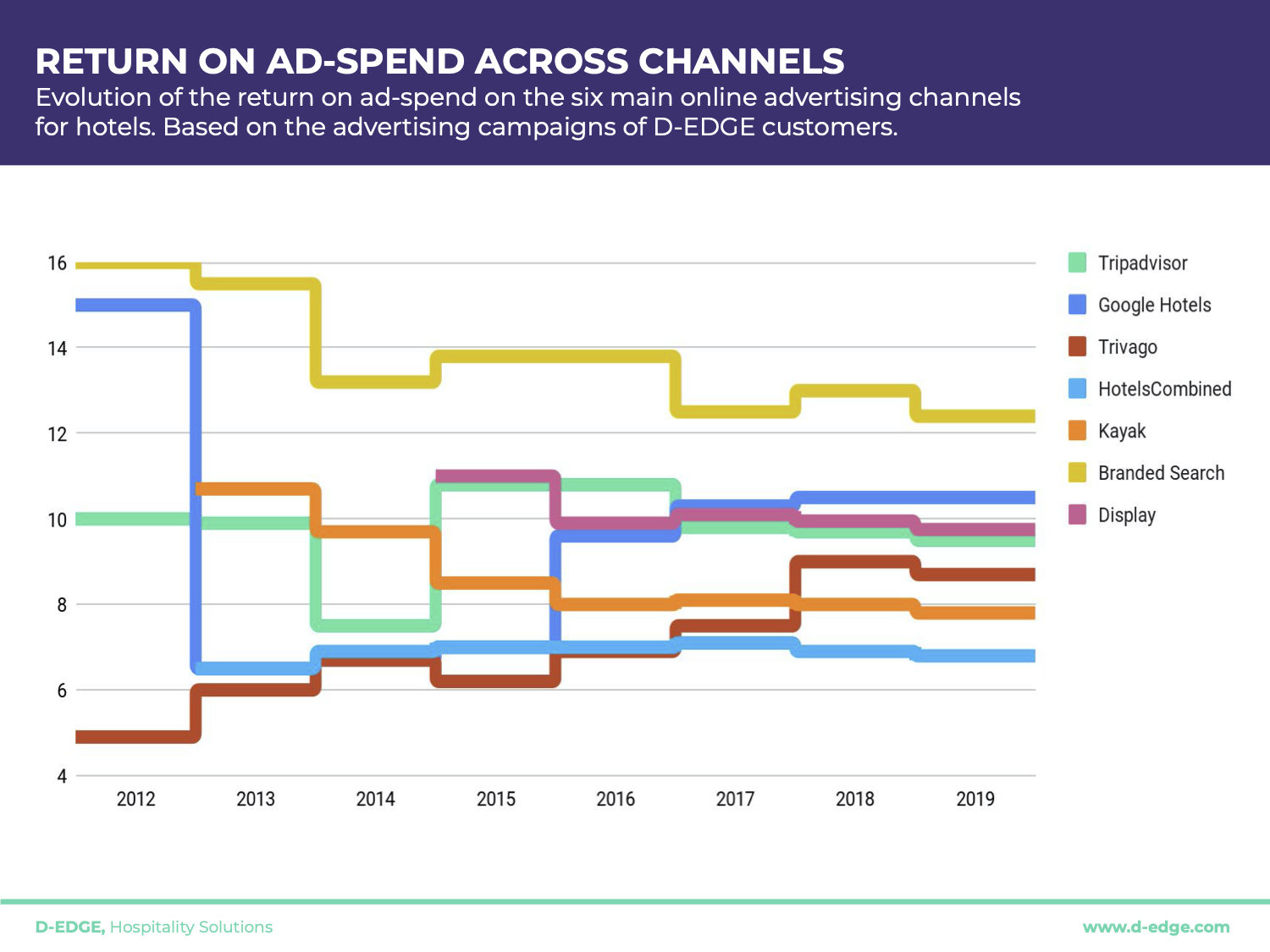

Following our 2017 report on the state of metasearch, we have updated it to show the data and the progress since then. We created this new study to help hotels plan and allocate their marketing budgets in the coming weeks and months, by investing in the channels with the highest return on ad spend. In the original report, we highlighted the characteristics of each meta platform and its evolution over time. In the span of just three years, the advertising landscape has changed dramatically in our industry; Display advertising has become the second-highest performing advertising channel for hotels. When we began working on the follow-up to “The State of Metasearch”, we decided to analyse not only the canonical metasearch platforms, but to include all those advertising channels that, directly or indirectly, contribute to hotels’ direct revenue.

Methodology and Key Findings

This study analysed a fixed pool of 954 properties worldwide which, over the span of the last eight years (2012 – 2019), have been using the D-EDGE digital media service suite. Interpreting this data, we discovered some major trends and patterns, such as:

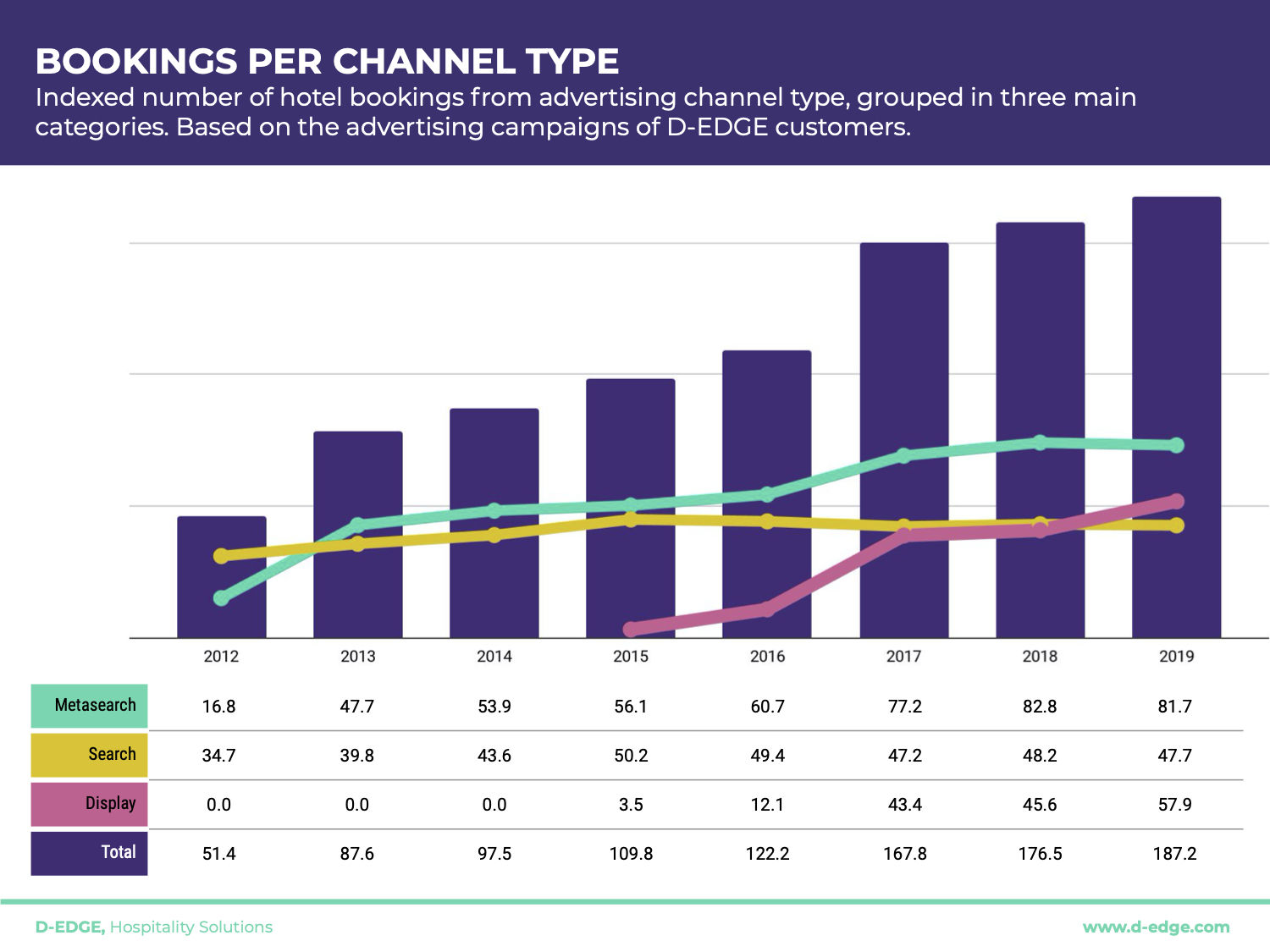

1. Bookings generated by ad-driven campaigns increased by 200% from 2013 to 2019.

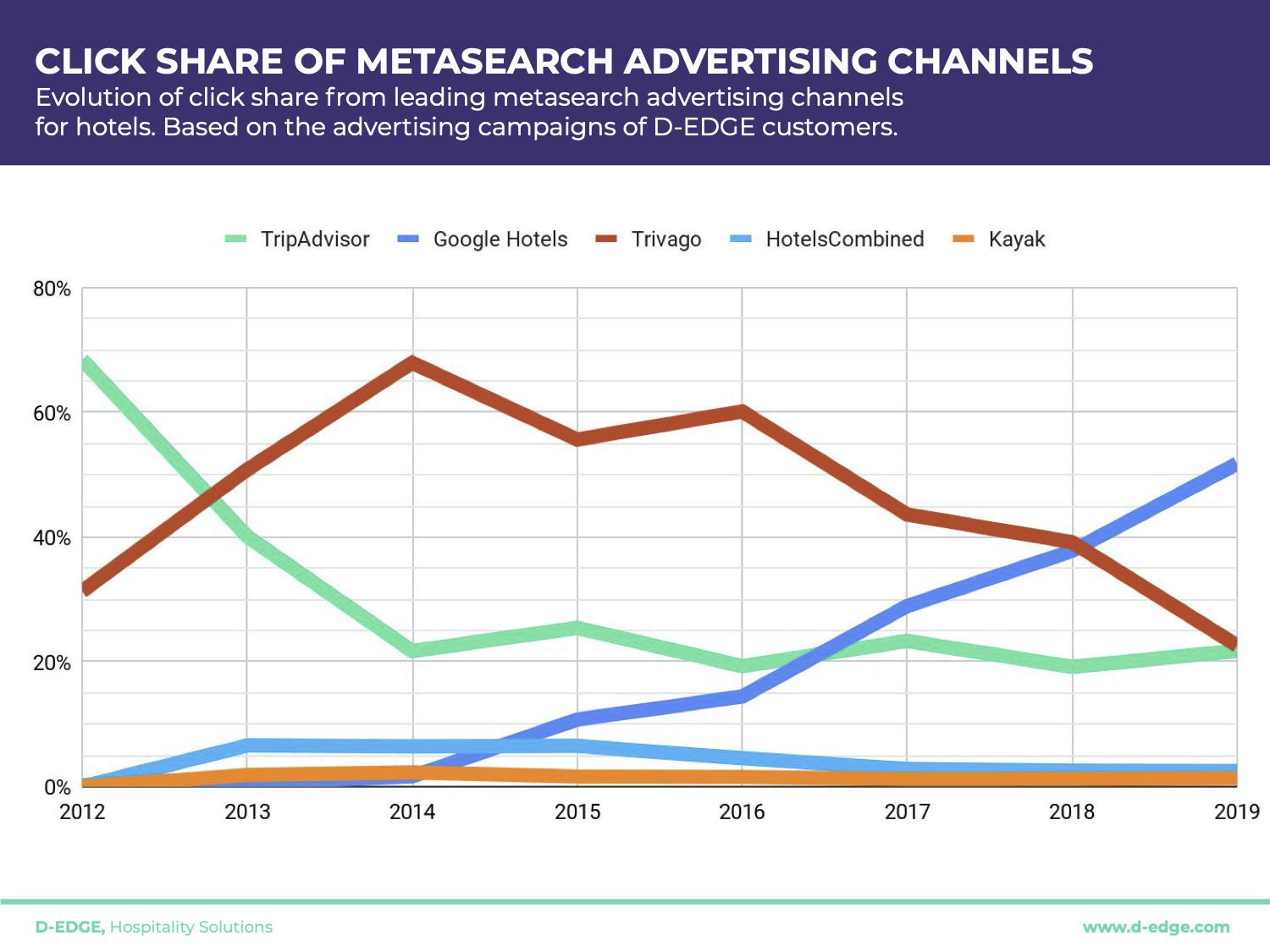

2. Tripadvisor has 14% of metasearch bookings in 2019 which is a decline from 65% in 2012.

3. Bookings from metasearch remain the largest ad-driven booking channel.

4. Display Advertising now generates 31% of ad-based bookings overtaking branded search.

5. Google Hotel Ads is now the largest metasearch channel in terms of the number of clicks and number of hotel bookings; it earns 57% of all metasearch bookings.

The chart below shows 2 clear phenomena: first, the huge increase in bookings linked to Digital Advertising as a whole (x3 since 2012) and second, the rapid growth of the bookings generated by Display Ads over the last few years.

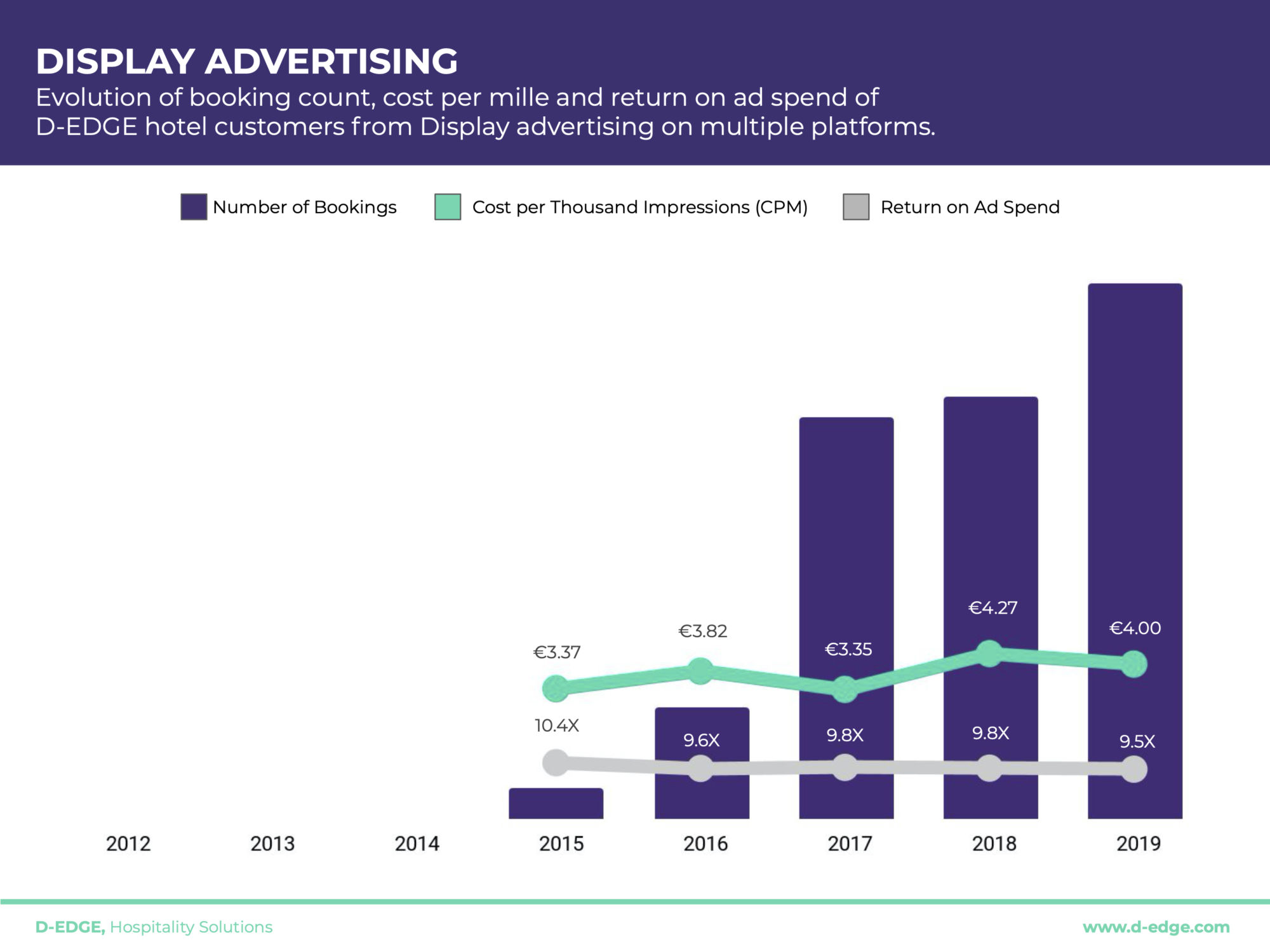

Display Advertising: The Safest Investment Of All

One of the key findings of our research, is the positive trend of Display advertising. At D-EDGE, we have implemented what we call Pre-targeting (a technique called also Prospecting) together with a network of partners and the use of classic Re-targeting. The growth of these channels has become a standard for our customers. Both for the very high ROI over the years (never below 9x), and for the volume of bookings generated.

In 2019 alone these channels generated as many bookings as Google Hotel Ads and TripAdvisor combined. Because display ads are not shown directly on search engine results, the use of this kind of campaign can increase visibility without the risk of traffic cannibalisation.

Metasearch: Still a winning formula

Metasearch has been the most reliable advertising channel to generate hotel bookings since 2013, but the market has changed several times in the last eight years. Since 2017, Google Hotel Ads started to become a large force not only in return on ad-spend (ROAS) but also in click volume. 2019 was the first year that saw Google Hotel Ads drive the highest volume of traffic to hotel websites. But click volume doesn’t tell the entire story. Later in this section we have broken down the key metrics for each key player (click volume, cost per click and return on ad-spend) to look into how best to allocate a hotel marketing budget.

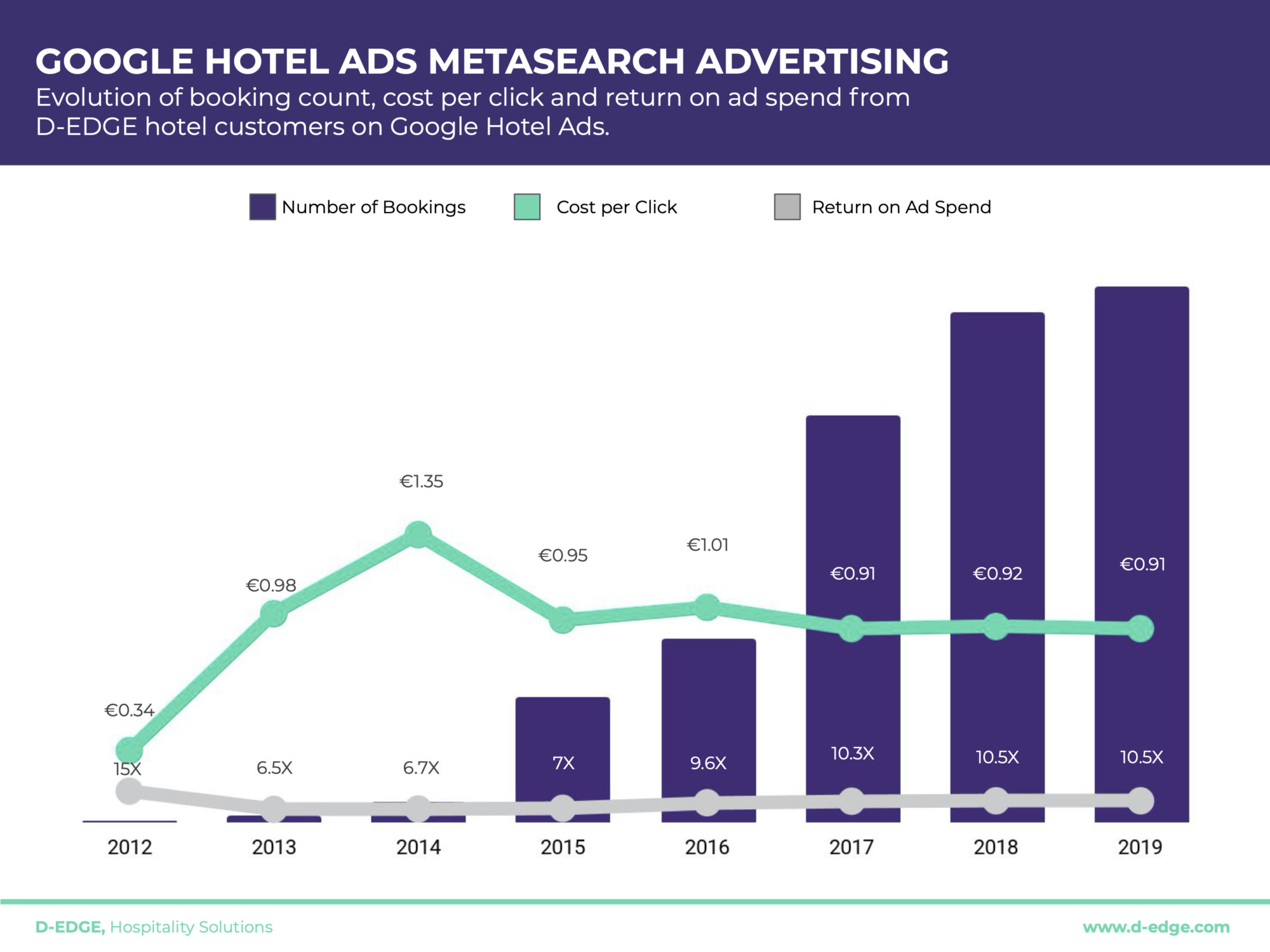

Google Hotel Ads: taking over the Metasearch Space

Today, metasearch ads in the hospitality space are almost synonymous with Google Hotel Ads. The growth of the company in the travel space seems to be unstoppable. The first incarnation of GHA launched nearly a decade ago under the name Hotel Finder. Back in 2012 Hotel Finder was generating less than 0.2% of market share, but in the span of 8 years that number jumped to 52%, more than TripAdvisor, Trivago, HotelsCombined, and Kayak combined. ROI-wise, Google is the undisputed winner as well, with an average return in 2019 of 10.5x, increasing steadily since 2013. The launch of google.com/travel in 2019, the implementation of Book on Google, and the recent Pay Per Stay (PPS) and Property Promotion Ads (PPA) features confirm the renewed interest Google has in the hospitality industry and cast a dim shadow over the future of other meta.

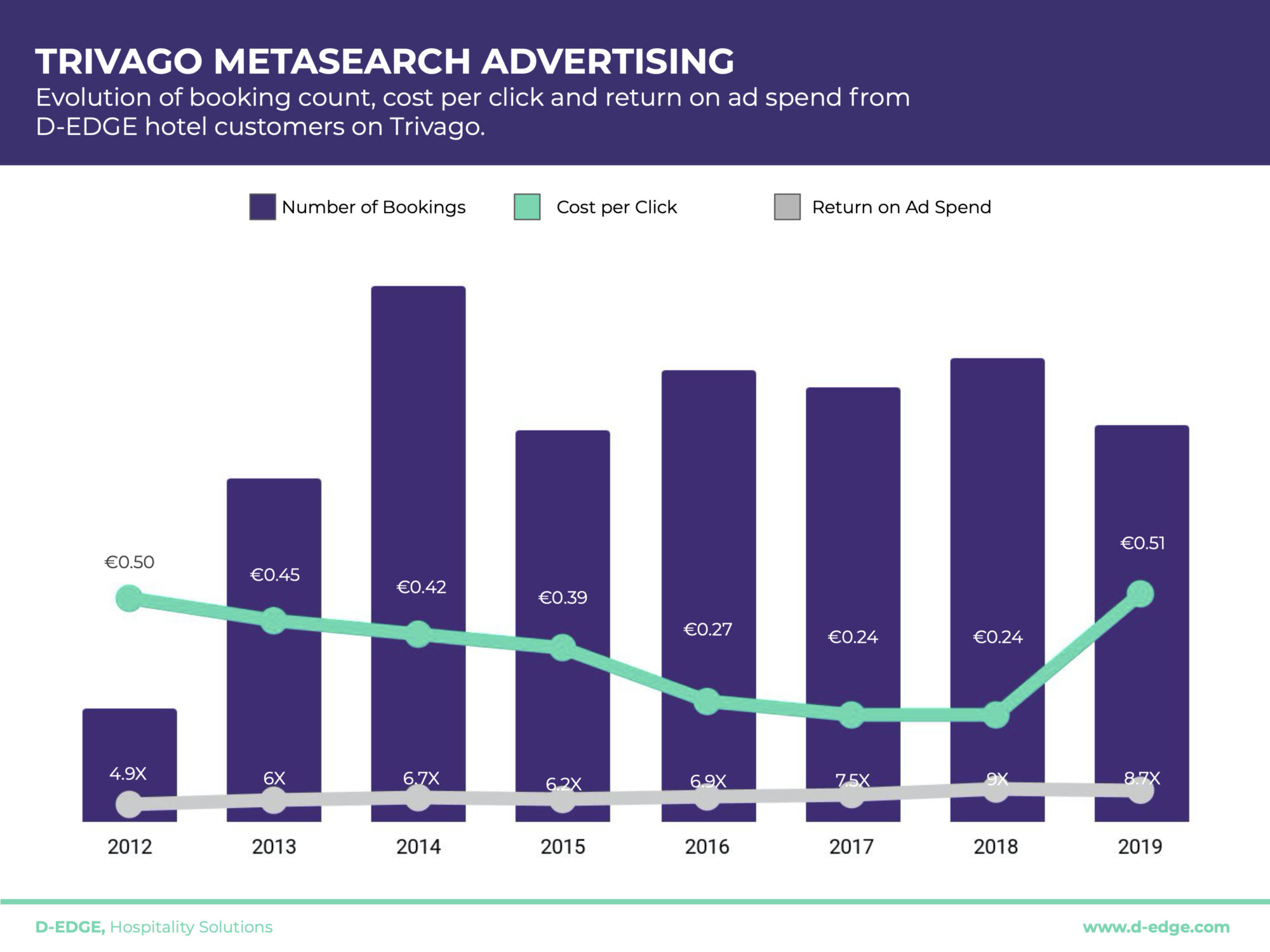

Trivago: A Low Risk Advertising Platform

Trivago, on the other hand, focused heavily on the implementation of its Business Studio (the suite offering hotel listings on the site and the “Rate Connect” metasearch CPC model) only. This more narrow offer of products can explain why performances for Trivago increased both in volume (17% increase in traffic from 2012 to 2019) and ROAS (the number of bookings increased by 248% over the same time). As a general rule, partners providing the cheapest rates on Trivago would hold a higher position in paid search, regardless of the bid offered. This meant that hotels publishing discounted rates on brand.com could have a more prominent slot in Trivago’s search results without overbidding the other partners. As recently determined by the Australian Competition & Consumer Commission, this may not always be the case, yet, without getting too technical, Trivago has greatly increased the quality of the traffic and has become a low-risk place to advertise on metasearch engines.

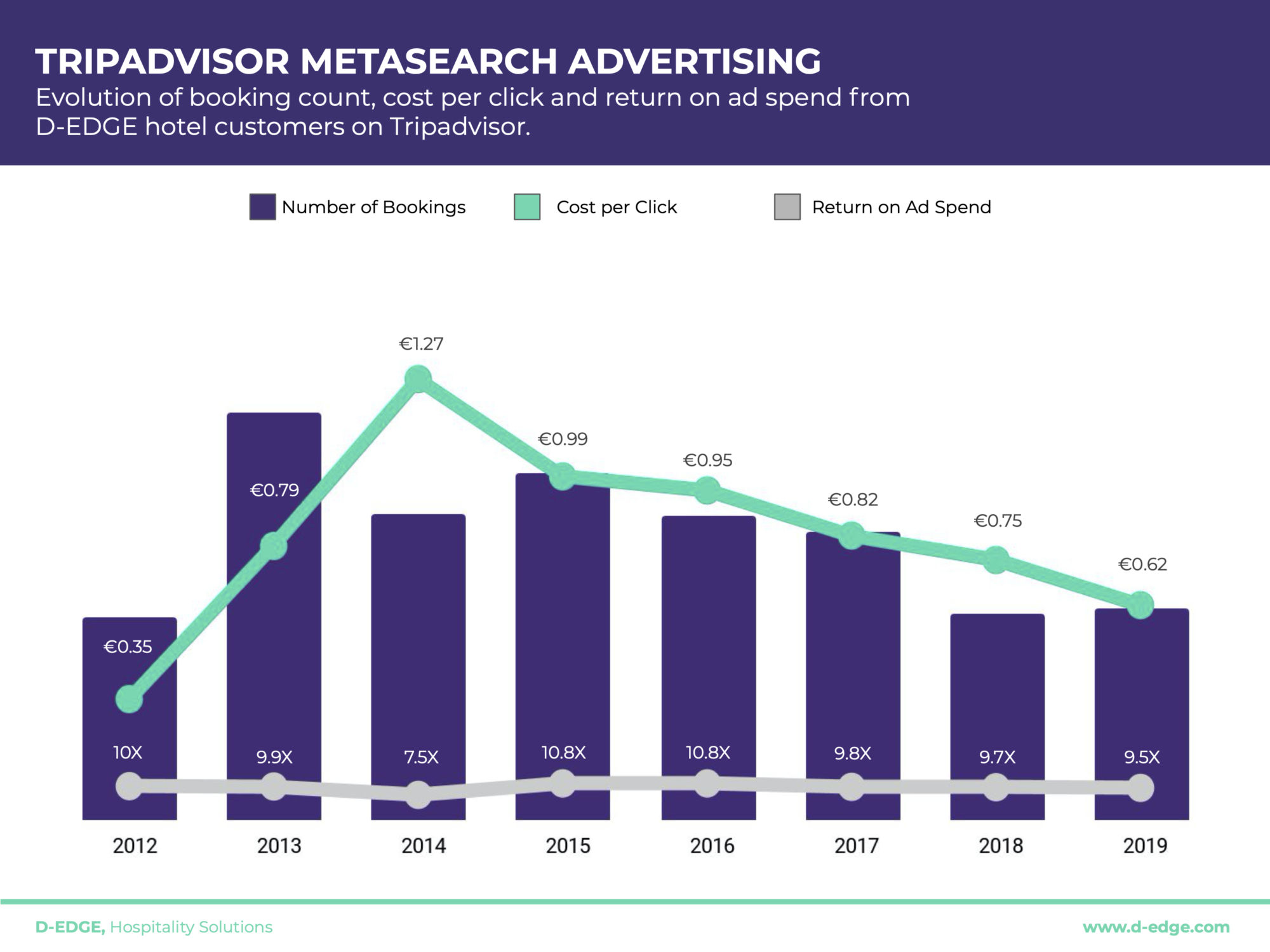

Tripadvisor: Stable returns, Decreased Volume

Over the years, the Return on Ad-Spend (ROAS) for Tripadvisor metasearch ads remained stable: 10X in 2012 versus 9.5X in 2019. What changed, is the volume. In 2019, Tripadvisor generated 52% fewer clicks than in 2012. Since new players came on board over the last decade (namely: Google), competition has obviously played a role. Yet, one of the main reasons for this drop could be found in the business model of Tripadvisor itself, and at a closer look, the decline seems to come from a change in business model and advertising products. Since the early 2010s, the company introduced a more extensive suite of products and features: the hotel price comparison in the results’ core page (2013); the “Instant Booking” facilitated booking tool (2014); the feed-based revamp and the introduction of the “Business Advantage” suite (both 2017); the new “Sponsored Placements” advertising solution and the self-service ad platform “Tripadvisor Media Manager” (both: 2019). Most recently they launched a co-branding ad platform, that allows advertisers to pair Tripadvisor audiences with the ad inventories and targeting capabilities of third-party sites, which for now include: Facebook and Instagram. As of today, Tripadvisor has ten new advertising products in beta test, so a certain degree of dilution in traffic coming from metasearch ads can be explained and puts the drop in volume in a more nuanced context. That being said, investments in Tripadvisor metasearch ads remain very qualitative with a very engaged and relevant audience.

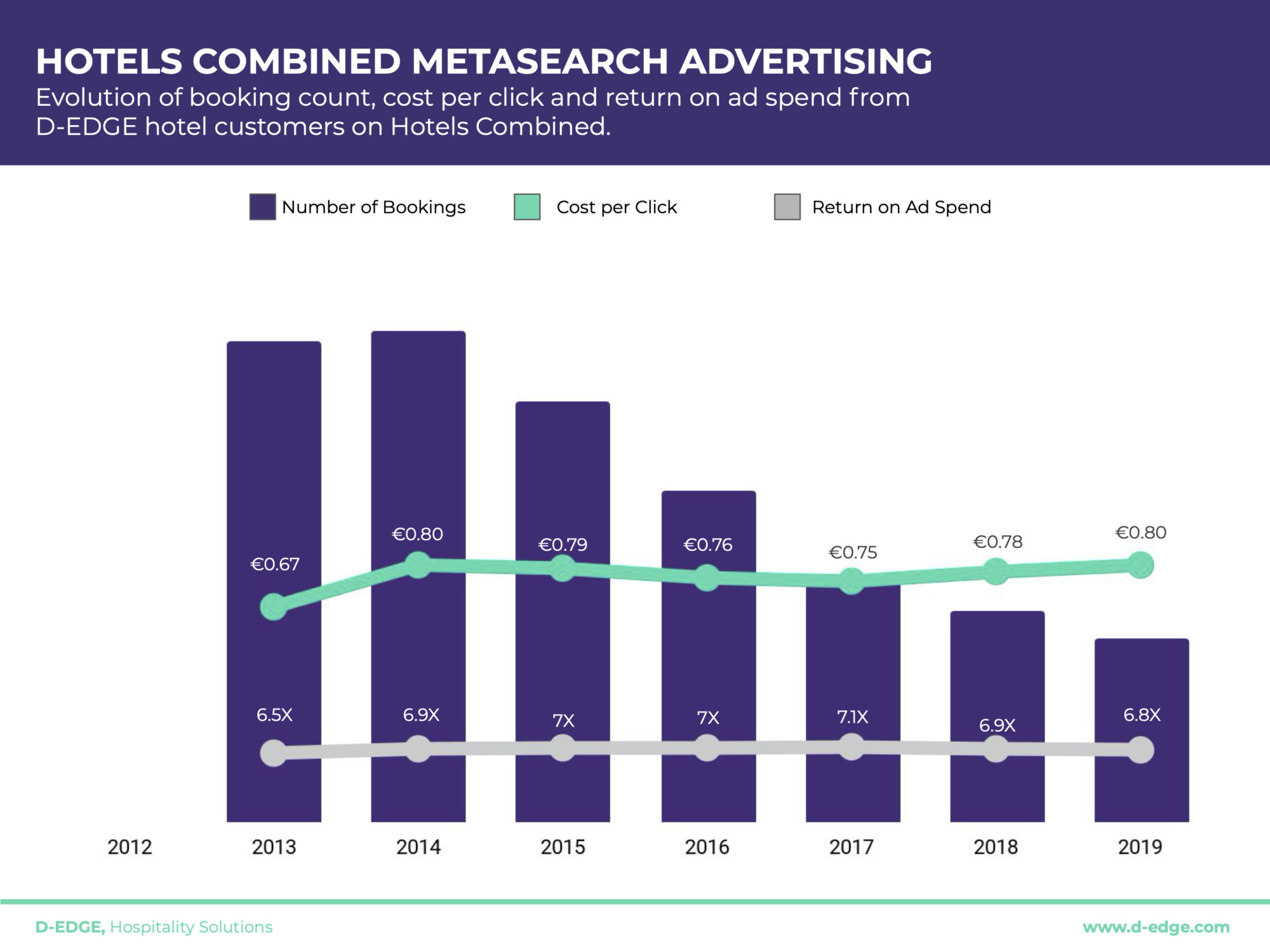

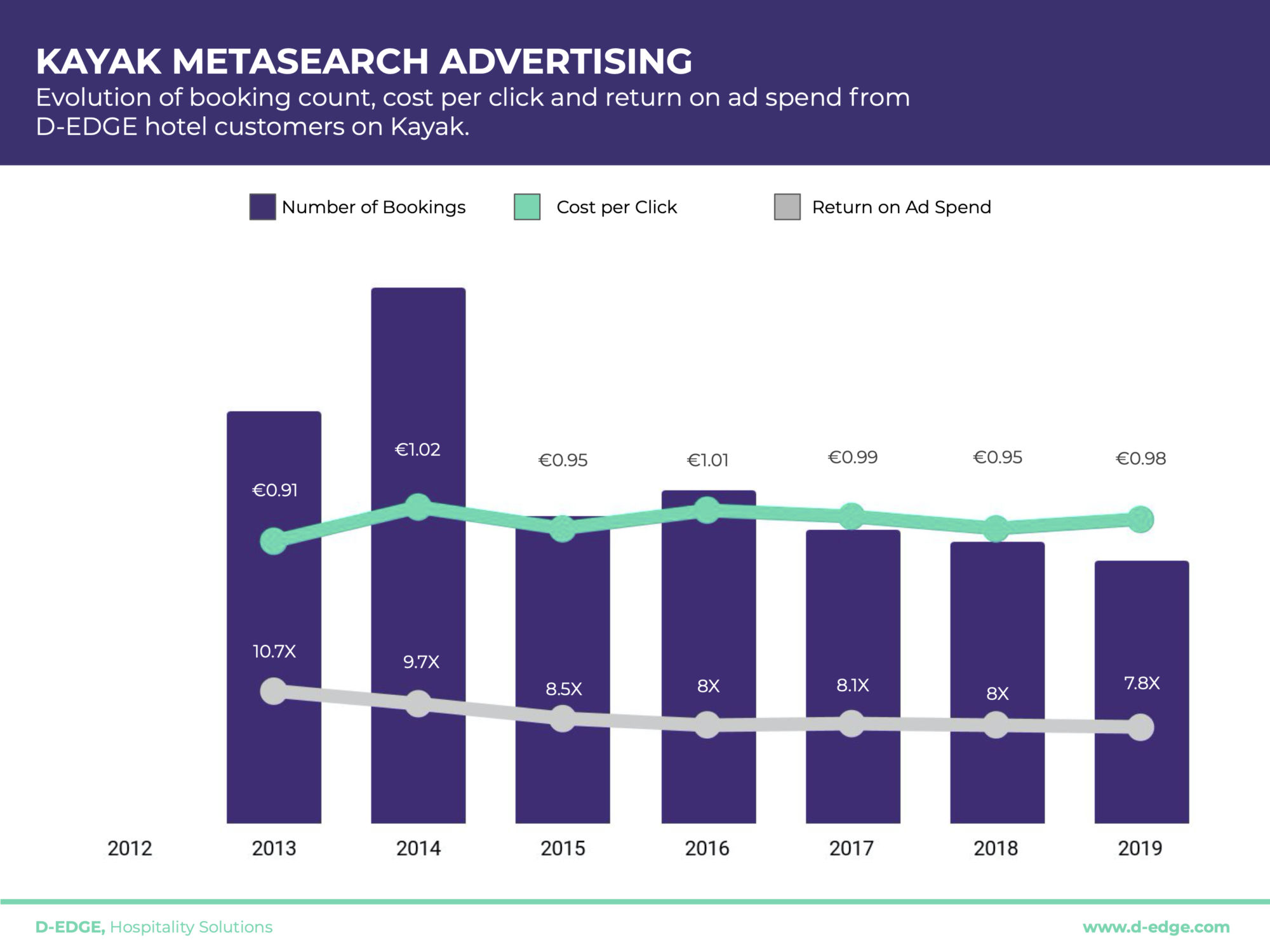

HotelsCombined and Kayak: An Opportunity for Niche Markets

Other metasearch engines, such as HotelsCombined and Kayak, create a fraction of the volume of TripAdvisor and Trivago. In 2019, HotelsCombined and Kayak had a combined volume equivalent to 17% of Trivago’s total volume for the same year.These other metasearch are, however, still acceptable in terms of ROI. Over the years, HotelsCombined fluctuated between 6.5x and 7.1x, with 2019 closing at a fair 6.8x. Kayak, on the other hand, saw its return on ad spend shrink from 10.7x to 7.8x over the course of eight years. But, HotelsCombined is still a good solution for hotels in Asia, and Kayak is more efficient for hotels in North America.

That being said, both metasearch engines require an investment of up to 1€/click to work, twice the investment needed on, let’s say, Trivago. (in general, advertising to a more targeted audience in a niche market tends to be more expensive on a per-click basis).

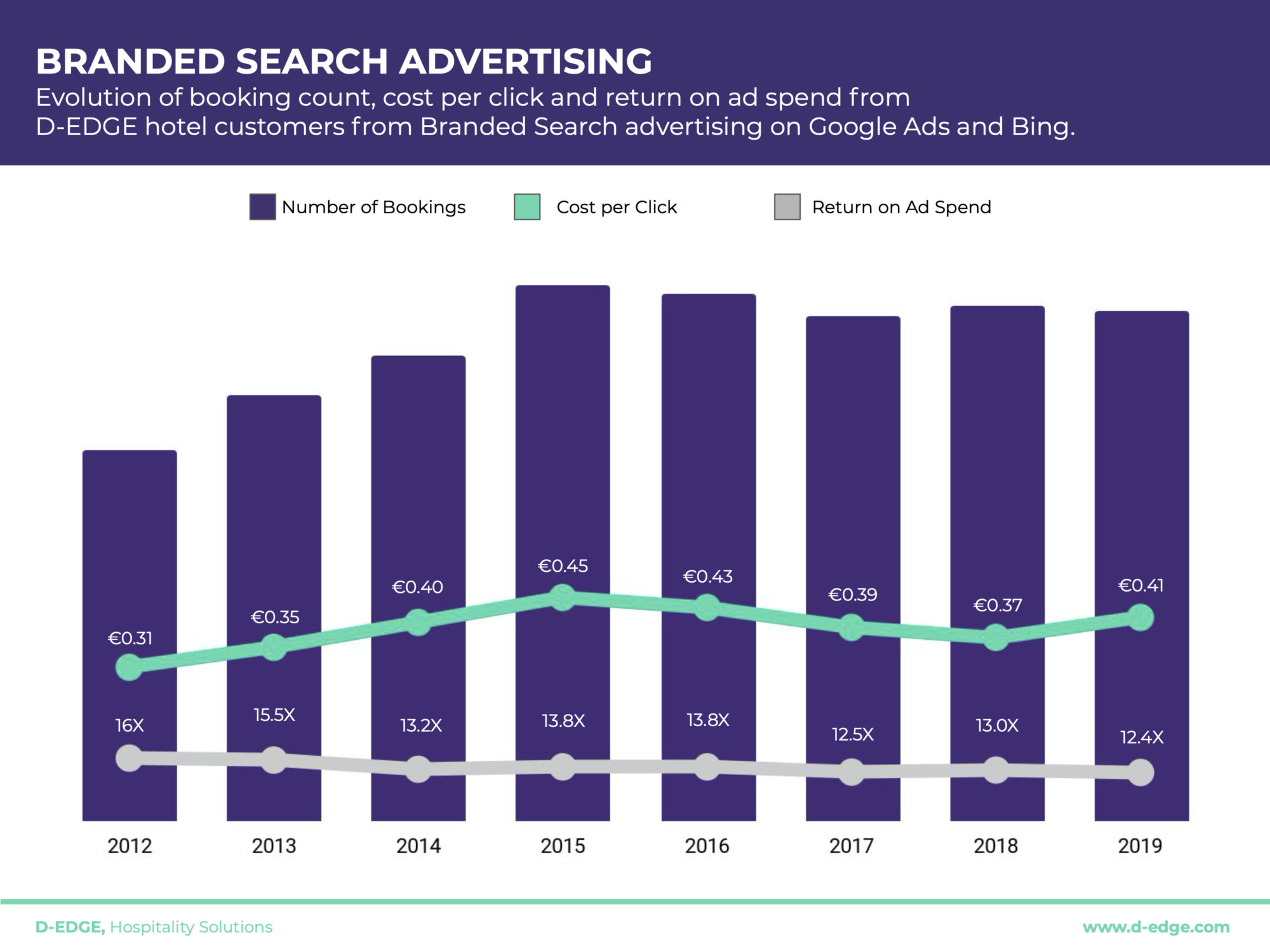

Search Advertising: Brand-Protection and Keyword-Triggered Campaigns

With meta results taking more and more space on the Google search engine results page, it is not surprising that classic search engine advertising has seen negative growth. Brand-protection on general search engines (Google and Bing), once the safest investments of all, paid the highest price, with ROI shrinking from 16x to 12.4x, and the average CPC increased by 10 cents (0.31€ in 2012 vs. 0.41€ in 2019). With Bing and Google both working on hotel advertising channels within search results, the situation for Microsoft’s search engine closely matches Google. According to Statista, in January 2020, Bing had a market share in the search engine space of close to 6%, while this figure was at 3% in 2010. The Microsoft search engine currently processes over 10 billion queries/month and it may be used by hoteliers as a secure sandbox to beta-test different advertising approaches, before implementing them on Google.

Average Cost-per-Acquisition

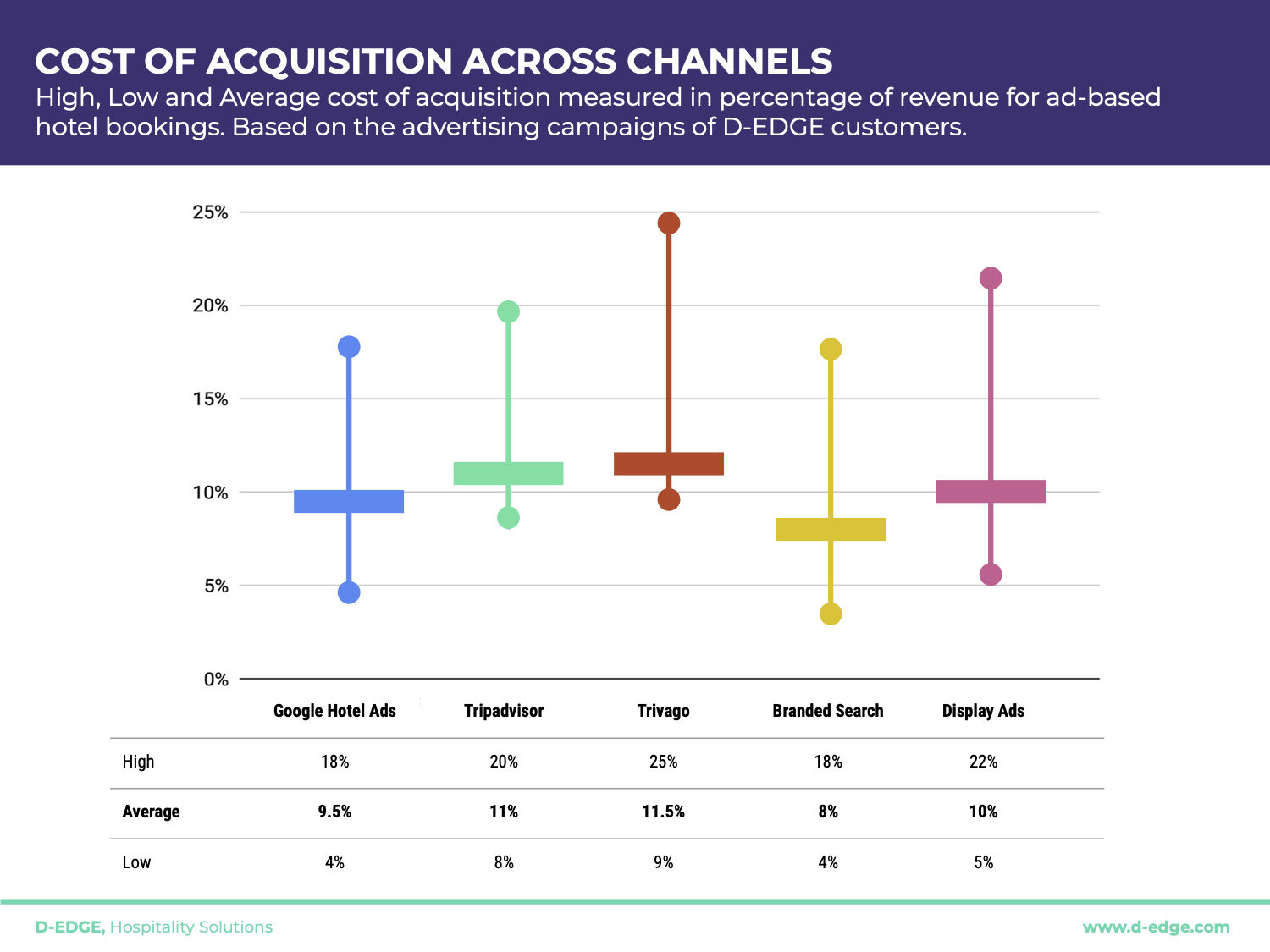

As a general rule, the Cost-per-Acquisition (CPA) for direct revenue should not be higher than the average commission paid to OTAs. Based on our findings, this is not always the case and fluctuations in costs can be quite significant. On average, the campaigns with the lowest cost per acquisition are the ones on the whole Google ecosystem, with search having the lowest (8%), followed by Google Hotel Ads (10%) and Display (10%). Tripadvisor and Trivago follow, with, respectively, 11% and 12% CPA. That being said, optimising campaigns and finding a healthy marketing mix remains imperative for any property. Display ads, for example, even with an average 10% CPA, can fluctuate from a minimum of 5% to a maximum of 22%, way higher than the average OTA’s commission cost. Also, in countries where the rate parity clause is no longer in force, hoteliers tend to offer cheaper rates on their brand.com, decreasing the direct CPA even more.

Return on Ad Spend vs Cost per Acquisition

While it is customary for digital marketing services to promote results in terms of Return on Ad Spend, we are tending towards using CPA as a model. This makes for a clearer comparison with OTA costs, and while direct marketing campaigns are complementary to OTA marketing, we believe it is important to compare like with like.

Many factors go into the cost of advertising: Rate parity, agency costs and of course brand building which is an important, though hard to measure result.

We have compared the various advertising channels with their minimum, maximum, and average cost of acquisition as a guide for our customers to have a clear view of their direct advertising costs compared to OTA distribution costs.

Optimising Ad Spend: Best Practices

For any hotel advertising campaign, one needs to balance visibility and return on ad spend. We have tried to give as much information as possible on the various types of online advertising channels that are appropriate for hotels.

To summarise this study, we have gathered some best practices from our marketing consultants and analysts that can be used as a guide for any hotel wanting to optimise their online advertising spend and increase returns.

1- The Best Offer

Guests are always going to be interested in a better rate or a better offer. To increase chances of a conversion on your brand.com website, ensure your best offer is on the channel on which you want to maximise conversions.

2-Optimised Website

A quality website optimised for conversion is critical. Key factors to this are high-quality images, fast load times and a website designed for mobile (which loads fast on mobile devices).

3-Booking Engine Performance

A good booking engine is quite subjective, however, the booking engine is key for converting incoming visitors into buyers. Some key attributes for your booking engine include: connected to Metasearch channels with a low error rate between published prices and actual prices, able to sell any type of rooms and rates, designed for mobile devices, streamlined user experience to final booking, and a good presentation of the rooms and rates.

4-Well set-up Tracking

To ensure your marketing efforts are being optimised, you need to ensure you are using a good tracking system; one which respects privacy and security of the website users while also reporting properly on the campaigns, sources and their performance. With the number of channels and campaigns possible, having a clear view on a macro and micro level of the various campaigns is critical.

5-Understanding the Shift to Mobile

We mentioned mobile-friendly websites and load-speed above. For several years now, traffic to hotel websites from mobile devices has been far more important than desktop traffic. However, bookings have remained very desktop centric. In the past few months, we have observed a marked increase in mobile bookings which underscores the importance of a mobile-friendly customer experience from inquiry through to booking (compared to just the presentation). In our recent research, we saw mobile bookings outpace desktop. While this might be a temporary change due to current circumstances, we recommend hotels observe this closely and adapt their booking experience for the shift.

RELATED SOLUTIONS

Display Marketing

Metasearch Marketing

Search Marketing

You may also like

Organic search remains one of your most powerful booking drivers—yet many hotels still don’t make the most of it. This…

Singapore, April 2025 – D-EDGE Hospitality Solutions, a global leader in hospitality technology, is proud to announce the renewal of its long-…

The 2025 Hotel Direct Distribution Report reveals the smartest strategies to boost ROI and future-proof your direct booking channels in an…

Paris, November 2024 – D-EDGE Hospitality Solutions, the leading provider of hospitality technology, is proud to announce its partnership with Pichet group,…

As the hospitality industry faces a new era of complexity, simply tracking basic performance metrics is no longer enough. Hoteliers need to…

Hotel Traveltine, Downtown Singapore – a stylish mid-scale property in Downtown Singapore, is redefining the competitive hospitality market with the power of…